PINELLAS COUNTY, Fla. — As of last week, 1.24 million Florida homeowners have the state’s “insurer of last resort,” Citizens Property Insurance. But now, some are worried about a mandatory flood insurance requirement, even if they aren’t in flood zones.

A bill out of last year’s legislative special session aimed at helping curb the property insurance crisis requires all Citizen’s residential policies to also have flood insurance in phases starting this month to January 1, 2027.

ABC Action News has received several messages from concerned homeowners and insurance agents, worried about the extra cost of the new requirement for residents in non-flood zones.

“I'm from St. Pete…right on the water, it’s beautiful, I would love to live on the water, but I specifically chose this area because it was a nonflood zone area,” expressed retired homeowner Mary Garst.

She moved back after working for decades in Chicago to retire in her hometown. She bought a three-bedroom, two-bath home near Interstate 275 and 54th Street in St. Petersburg.

In the six years she has owned the home, she has been with three different property insurance companies.

Garst said she was dropped from her first insurance company due to an older roof.

Her most recent bill with Security First went from $1,800 last year to $3,900 this year.

“I said that's crazy,” Garst exclaimed.

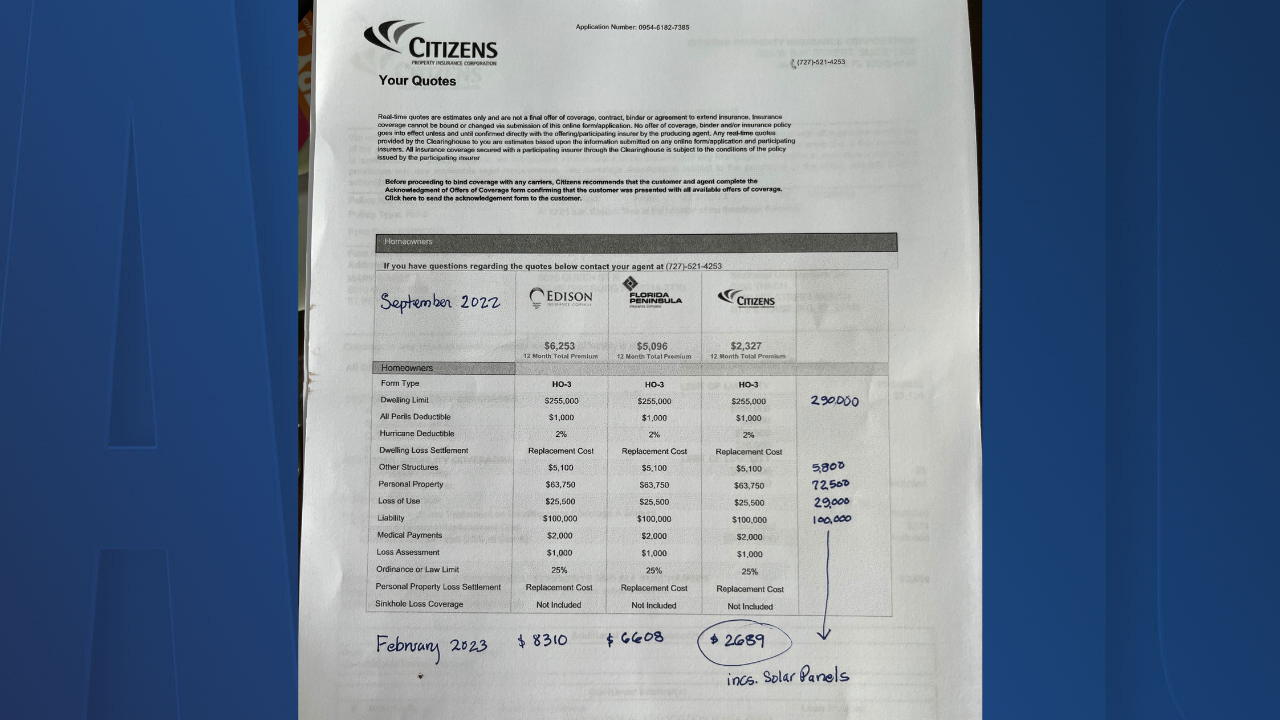

In September, her insurance agent got some quotes from different companies.

“Edison was over $6,200, Florida Peninsula was $5,000, Citizens at that time was $2,300,” Garst said as she showed ABC Action News the printout.

She held off and ran the quotes again in February of this year and found they had only increased.

“Edison was at $8,300, Florida Peninsula was $6,600, and then Citizens came in at $2,689,” she exclaimed.

Citizens was all she could afford. Then her agent informed her she’ll soon have to get flood insurance as well.

“I said, ‘But I'm not in a flood zone. I’m on the crest of St. Petersburg; why do I have to get flood insurance?’”

That’s a question many Floridians are asking.

The requirement came out of the Florida legislature’s second special session of 2022 after Hurricane Ian.

Senate Bill 2-A requires every residential policy to have flood insurance as a condition of having coverage from Citizens, but they’re implementing it in phases.

For those in a FEMA-designated flood zone, new policies had to get flood insurance by April 1 and any policy renewals have until July 1, 2023.

For those not in flood zones, it depends on your property value:

- January 1, 2024, for property valued at $600,000 or more.

- January 1, 2025, for property valued at $$500,000 or more.

- January 1, 2026, for property valued at $400,000 or more.

- January 1, 2027, for all other personal lines residential property insured by Citizens.

We went to Citizens to ask why they need homeowners in non-flood zones to have flood coverage.

“Following Hurricane Ian, you saw what happened in Orlando. So many people, even in the hardest hit areas, were not in flood zones and did not have flood insurance,” answered Citizens Spokesperson Christine Ashburn.

An analysis by CoreLogicafter Hurricane Ian showed uninsured flood loss from the storm cost $10 to $16 billion in Florida.

For many hurricane victims, claims become more complicated, involving mediation and even legal action with disputes of wind verse flood damage.

“I believe the public policy correlation there is if you're going to be insured to the insurer of last resort in Florida, where our rates are subsidized, right? And we can assess all Floridians if we run out of money; we want to be sure people are covered in the event there was a flood in their home, so we don't have a wind versus flood argument with Citizens because of our government entity status.”

Garst said her lowest quotes for flood insurance were between $400 and $500.

“I'm going from $1,800 up to $2,689, and the flood insurance would be an additional four to $500 on top of that,” she said. "Thank God I have… a little leeway because of my IRAs, but I don't know how anybody does it if they're just on Social Security."

Garst is the vice president of her neighborhood association and said it's the number one topic of concern for all of her neighbors.

"There are people here that are on fixed incomes, social security, and I don't know how they're going to pay to have their houses covered. However, if you own your house and have no mortgage, you don't have to have homeowners insurance, so if anything does happen, you don't have insurance, and there are people that are doing that," Garst explained.

“This is something that our governor really needs to address and he has not addressed it to keep the pricing down," she concluded.

We reached out to Governor Ron DeSantis’ office to ask about the financial concerns of homeowners with Citizens who are not in flood zones.

A spokesperson for his office referred us to Florida’s Office of Insurance (OIR) regulation for an answer. We have not received a response from OIR.

You can find your flood zone on the FEMA website, but it may be easiest to go through your county website.

According to the Insurance Information Institute, private flood insurance is the most robust market in the U.S. A spokesperson said that there are nearly 50 private flood companies writing in Florida, that’s in addition to the government-backed National Flood Insurance Program.

Homeowners can visit FloodSmart.gov or the Florida Office of Insurance Regulation website for information about flood insurance and finding a flood insurance provider. There may be a waiting period to obtain flood insurance, according to Citizens.

Here is information from Citizen’s bulletin in:

All existing personal residential policies renewing on or after July 1, 2023 – that include wind coverage and are located in the special flood hazard area as defined by the National Flood Insurance Program (NFIP) – are required to have flood insurance.

Additionally, all impacted customers will be required to sign and submit a Policyholder Affirmation Regarding Flood Insurance (CIT FW01).

Coverage Requirements:

Under the new rule, an existing policyholder located in a special flood hazard area and whose policy includes wind coverage is required to secure flood coverage from the NFIP or a private insurance carrier at the following limits:

- Dwellings: Equal to or greater than Citizens’ separate Coverage A and Coverage C limits

- Condominium or unit owners: Equal to or greater than Citizens’ separate Coverage A and Coverage C limits

- Tenant contents: Equal to or greater than Citizens’ Coverage C limit

- Cooperative unit owners: Equal to or greater than Citizens’ Coverage C limit

If the above limits are not available from the NFIP, Citizens will accept the maximum coverage amount for which the insured is eligible. Maximum NFIP limits:

- Regular Program: $250,000 Coverage A, $100,000 Coverage C

- Emergency Program: $35,000 Coverage A, $10,000 Coverage C